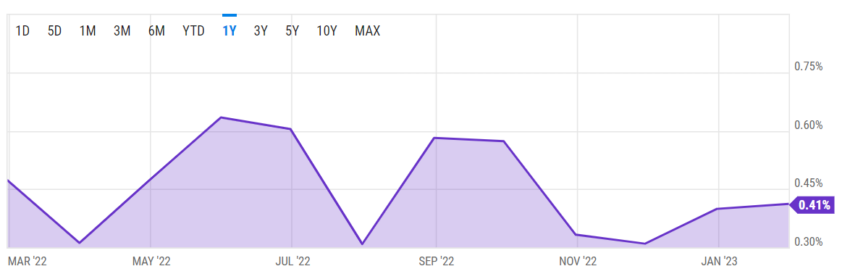

The month-on-month headline CPI for Jan. 2023 rose 0.5%, while the core CPI, excluding gas and energy prices, rose 0.41%, up from 0.3% in Dec. 2022.

The so-called reinflation observed in the core CPI has some investors worried that equities markets could turn bearish, even as cryptos rally.

Higher Core CPI Keeps Cryptos Mostly Flat, But Beware of Reinflation

After CPI news broke, macro commentator tedtalksmacro сунуш that the increase in core баанын болот drive markets bearish. Federal Reserve Chair Jerome Powell said that because housing creates a floor for headline inflation, the Federal Reserve prefers to look at core CPI to determine the effects of rising interest rates.

Equities markets remained largely flat after the news, with Dow Jones келечеги falling 5 points, while S&P 500 futures ticked 0.12% lower. Treasury yields fell 2-3 basis points before rising and later falling to lower values than before the CPI data was released.

Housing costs, which drove the headline increases, rose 0.7% in January 2023 and 7.9% from a year ago. Medical expenses fell 0.7%, while airline fares were down 2.1%.

The so-called headline consumer price index offers granular insight into the average price change of a basket of goods and services. Core CPI, on the other hand, excludes food, energy, and housing costs.

Кулактандыруудан кийин, терминалдарда fell to $21,600 but later rose to $22,000. ETH also fell to around $1,501, but recovered to $1,547. ADA rose 2% to roughly 38 cents after falling to under 35 cents, while SOL dropped to $21.11 before rallying to $21.96.

Markets Rallied on “Disinflation” Rhetoric at Last FOMC Meeting

The strength of the U.S. economy, evidenced by the highest employment rate in over a decade, and Fed chair Powell’s admission that the “деинфляциялык процесс” had started in his Federal Open Markets Committee speech, has driven markets mostly positive in recent weeks despite risks of a mild recession in 2023.

“Inflation is easing, but the path to lower inflation will not likely be smooth,” мындай деди: Jeffery Roach of LPL Financial.

At the same time, Powell cautioned that it would be “абдан эрте to declare victory or to think we really got this.”

Analysts expect the Fed will increase interest rates by 25 basis points at its next Open Markets Committee meeting in late March 2023, which will take the federal funds rate to above 5.1%.

Last month Powell emphasized that while some areas of the economy are tightening in response to rising interest rates, the tight labor market still presents a significant challenge in bringing inflation to the bank’s 2% target.

The Federal Reserve uses monetary policy to fulfill its dual mandate of price stability and maximum employment but does not directly influence the U.S. labor market.

“We want to guarantee, to the extent we can, that inflation will come down and get back on a steady path toward the 2% target. And we don’t want to waver in that, because one of the problems in the 1970s is that inflation kept coming back just when you thought you killed it,” St Louis Federal Reserve Governor James Bullard told Bloomberg Учтүн 20, 2023 боюнча.

Powell anticipates that interest rates will continue rising until the end of 2023 unless the bank sees inflation coming down faster.

Be[In]Crypto'нун эң акыркысы үчүн терминалдарда (BTC) анализ, чыкылдатуу бул жерде.

баш тартуу

BeInCrypto акыркы окуялар жөнүндө расмий билдирүү алуу үчүн окуяга катышкан компанияга же жеке адамга кайрылды, бирок ал азырынча жооп ала элек.

Source: https://beincrypto.com/higher-cpi-beneficial-for-crypto-market/